Impression of US tariffs on India: India’s GDP might take a success of round 0.1 to 0.6 share factors because of the proposed US tariffs, in keeping with a current Goldman Sachs evaluation. The examine examines eventualities of US tariff implementation: country-level and product-level reciprocity.

It states, “India’s home exercise publicity to US ultimate demand can be roughly twice as excessive (4.0 per cent of GDP) given publicity to the US through exports to different international locations, and would possible lead to a possible home GDP progress affect of 0.1-0.6pp.”

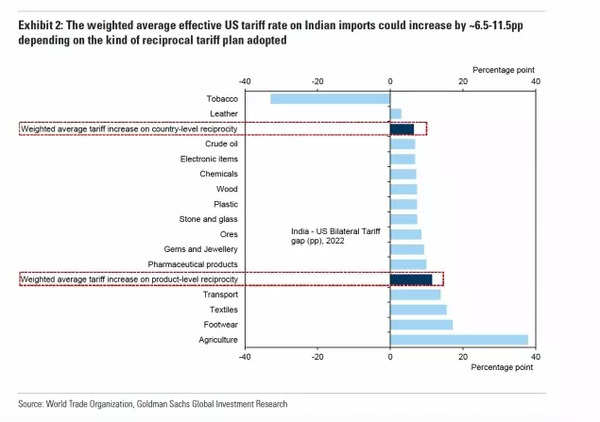

Ought to the US administration decide to boost tariffs on all imports by the common tariff differential between particular international locations and itself, the efficient US tariff charges on Indian imports would see a rise of 6.5 share factors, it says.

On February 13, President Trump directed his crew to create a “Truthful and Reciprocal Plan”. The following memo outlined a technique to equalise tariffs, taxes and non-tariff limitations with different nations. Throughout his February 13 press convention, Trump particularly talked about India alongside the European Union and China, stating that India maintained “the best tariffs on this planet”.

Additionally Learn | ‘Extra of white noise’: Why Trump’s reciprocal tariffs on India’s exports to US could have a ‘restricted’ affect

India-US Commerce Dynamics:

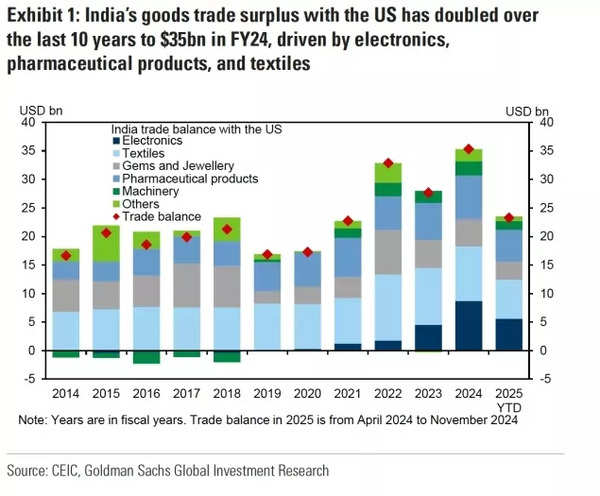

- India’s two-way items commerce surplus with the US has seen a twofold enhance prior to now decade, rising from $17bn (0.9% of India’s GDP) in FY14 (fiscal yr runs from April to March) to $35bn (1.0% of GDP) in FY24.

- The surge is primarily attributed to heightened commerce surplus in digital gadgets, following the implementation of fiscal incentives by the PLI scheme in 2020.

India’s Items Commerce Surplus with the US

- The tariff construction exhibits India sustaining increased charges in comparison with the US throughout most product classes, with notable variations noticed in agricultural merchandise, textiles, and pharmaceutical merchandise.

Weighted Common Efficient US Tariff

Goldman Sachs outlines three potential implementation approaches for the “reciprocal tariff” scheme:

1. Nation-level reciprocity: The primary strategy entails country-level reciprocity, the place the US administration may increase tariffs on all imports by the common tariff distinction between a selected nation and the US. This could lead to roughly 6.5 share factors enhance in US efficient tariff charges on Indian imports. The US economics crew suggests this as probably the most easy implementation technique, permitting officers to use a single uniform fee per nation on present tariff charges.

2. Product-level reciprocity: The second technique focuses on product-level reciprocity, the place the US administration would equalise tariff charges on particular person merchandise with these imposed by buying and selling companions. This might result in roughly 11.5 share factors enhance in US efficient tariff charges on Indian imports. This strategy requires extra complicated administration and longer implementation intervals. A White Home memo dated February 13 requires the Workplace of Administration and Funds (OMB) to offer a report back to the President inside 180 days.

3. Reciprocity together with non-tariff limitations: The third strategy encompasses reciprocity together with non-tariff limitations, akin to administrative obstacles, import licensing necessities, and export subsidies. This represents probably the most complicated implementation technique on account of difficulties in calculating non-tariff barrier prices for every buying and selling associate. Consequently, the evaluation focuses solely on tariff-related limitations.

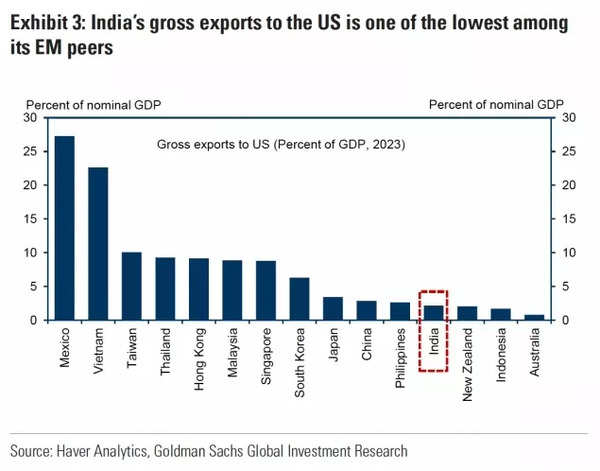

Goldman Sachs’ evaluation of India’s vulnerability to US tariff modifications begins with inspecting export publicity. India’s exports to the US accounted for about 2.0% of its GDP in 2023, representing one of many smallest exposures amongst rising market economies.

Additionally Learn | Tesla India entry: Why Donald Trump has stated it could be ‘very unfair’ for Elon Musk’s Tesla to arrange a manufacturing facility in India

The important thing think about figuring out the financial affect lies in understanding how responsive Indian exports are to US tariff changes, particularly specializing in the worth elasticity of American demand for Indian items.

India’s gross exports to the US

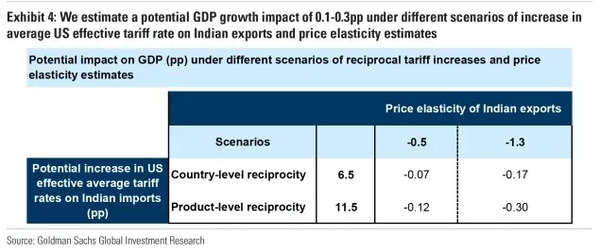

- The evaluation considers varied eventualities, incorporating totally different ranges of US tariff will increase on Indian imports and utilising elasticity estimates from present analysis. The calculations recommend that these tariff changes may cut back India’s GDP progress by 0.1-0.3 share factors throughout totally different eventualities.

- In keeping with Goldman Sachs, when India’s gross exports to the US quantity to roughly 2% of GDP, and contemplating an 11.5 share level rise in common US efficient tariff charges on Indian imports with a worth elasticity estimate of -0.5, the resultant GDP affect can be 0.12 share factors (2%*11.5*-0.5=-0.12pp).

Potential affect on GDP

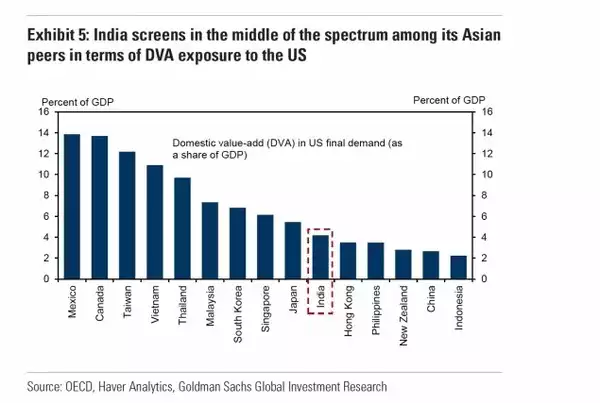

- Within the state of affairs the place the US implements a common reciprocal tariff throughout all nations, the suitable indicator for evaluating a home financial system’s US publicity can be the home worth added content material in gross exports to US ultimate demand, as per the OECD’s Commerce in Worth-Added Database.

- This indicator exactly measures a rustic’s home exercise publicity to the US. With India’s home worth added content material in gross exports at roughly 4.0% of GDP, it positions itself centrally amongst its Asian counterparts. Utilizing this measurement, the potential affect on home GDP progress, contemplating a 6.5-11.5 share level enhance in US common efficient tariff charges, would possible fall between 0.1 and 0.6 share factors.

India in center of spectrum

var _mfq = window._mfq || [];

_mfq.push([“setVariable”, “toi_titan”, window.location.href]);

!(function(f, b, e, v, n, t, s) {

function loadFBEvents(isFBCampaignActive) {

if (!isFBCampaignActive) {

return;

}

(function(f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function() {

n.callMethod ? n.callMethod(…arguments) : n.queue.push(arguments);

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://connect.facebook.net/en_US/fbevents.js’, n, t, s);

fbq(‘init’, ‘593671331875494’);

fbq(‘track’, ‘PageView’);

};

function loadGtagEvents(isGoogleCampaignActive) {

if (!isGoogleCampaignActive) {

return;

}

var id = document.getElementById(‘toi-plus-google-campaign’);

if (id) {

return;

}

(function(f, b, e, v, n, t, s) {

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

t.id = ‘toi-plus-google-campaign’;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://www.googletagmanager.com/gtag/js?id=AW-877820074’, n, t, s);

};

function loadSurvicateJs(allowedSurvicateSections = []){

const section = window.location.pathname.split(‘/’)[1]

const isHomePageAllowed = window.location.pathname === ‘/’ && allowedSurvicateSections.includes(‘homepage’)

if(allowedSurvicateSections.includes(section) || isHomePageAllowed){

(function(w) {

function setAttributes() {

var prime_user_status = window.isPrime ? ‘paid’ : ‘free’ ;

w._sva.setVisitorTraits({

toi_user_subscription_status : prime_user_status

});

}

if (w._sva && w._sva.setVisitorTraits) {

setAttributes();

} else {

w.addEventListener(“SurvicateReady”, setAttributes);

}

var s = document.createElement(‘script’);

s.src=”https://survey.survicate.com/workspaces/0be6ae9845d14a7c8ff08a7a00bd9b21/web_surveys.js”;

s.async = true;

var e = document.getElementsByTagName(‘script’)[0];

e.parentNode.insertBefore(s, e);

})(window);

}

}

window.TimesApps = window.TimesApps || {};

var TimesApps = window.TimesApps;

TimesApps.toiPlusEvents = function(config) {

var isConfigAvailable = “toiplus_site_settings” in f && “isFBCampaignActive” in f.toiplus_site_settings && “isGoogleCampaignActive” in f.toiplus_site_settings;

var isPrimeUser = window.isPrime;

var isPrimeUserLayout = window.isPrimeUserLayout;

if (isConfigAvailable && !isPrimeUser) {

loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive);

loadFBEvents(f.toiplus_site_settings.isFBCampaignActive);

loadSurvicateJs(f.toiplus_site_settings.allowedSurvicateSections);

} else {

var JarvisUrl=”https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published”;

window.getFromClient(JarvisUrl, function(config){

if (config) {

const allowedSectionSuricate = (isPrimeUserLayout) ? config?.allowedSurvicatePrimeSections : config?.allowedSurvicateSections

loadGtagEvents(config?.isGoogleCampaignActive);

loadFBEvents(config?.isFBCampaignActive);

loadSurvicateJs(allowedSectionSuricate);

}

})

}

};

})(

window,

document,

‘script’,

);