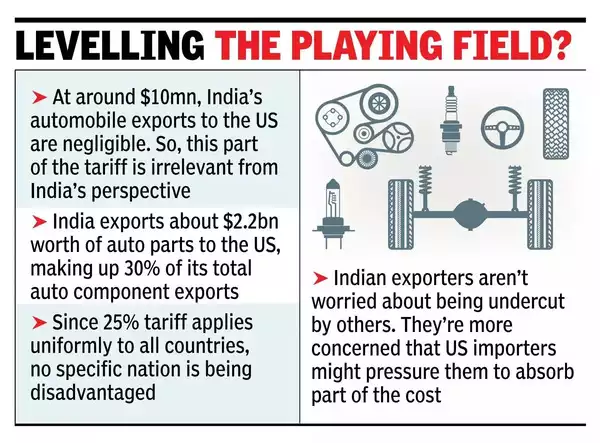

Spoiler alert-the 25% tariff imposed on auto and auto elements is more likely to have little detrimental influence on India. Car tariffs would take impact from April 3 and tariffs on auto elements would take impact ”no later than Could 3 2025” in line with MEMA, Motor Tools producers Affiliation of USA. Firstly on cars, India’s whole exports to US at round $10 million, would roughly equate to a rounding error in Japan’s car exports to US and is totally insignificant.

On car elements, India is a extra severe contender with $2.2 billion exports to US, comprising practically 30% of India’s whole car element exports. However positioned in context, that is below 3% of US’ whole car elements imports. This isn’t actually what Donald Trump is concentrating on, however may turn out to be collateral injury in his assault on the large exporters of elements to US- Canada, Mexico, China and others.

Nevertheless, the probability of being collateral injury is minimal. The 25% tariff is being utilized uniformly to all international locations, so each nation’s aggressive benefit is impacted equally. Auto elements corporations in India don’t concern being outpriced by opponents on this account. What they do concern is strain from importers to soak up at the least part of the price, thereby eroding profitability considerably. Some corporations anticipating this risk have already began a price discount drive.

The opposite attainable menace is native producers in US utilizing this protect of 25% to arrange manufacturing in US and outprice imports. That is possible towards excessive price international locations like Germany, Japan, Canada and so forth, that may lose out fully to US producers. Nevertheless the equation is completely different in case of low price international locations like India, Vietnam, China and a few East European nations. Even with the 25% benefit, US producers would discover it difficult to match the costs of elements from low price nations.

The reason being that the price benefit loved by low price international locations as a consequence of labour arbitrage will not be in percentages, however in orders of magnitude. As towards a employee in auto elements paid Rs 30,000 to 40,000 per 30 days in India, a typical US employee can be paid at the least $4000/month. This may translate to a ten:1 price benefit in labour, however the wage benefit is offset by increased productiveness in US. This could possibly be wherever between 2 or 3:1 . This isn’t as a result of employees within the US work thrice as shortly as Indians. Human productiveness as a consequence of physique is an element, and machine velocity is one other however what is important within the productiveness distinction is automation. This ends in man machine ratios which may be1: 2 or 1:3 in US vs 1:1 in India. Moreover, Indian corporations are inclined to make use of bigger numbers of oblique labour in comparison with US the place materials motion, and different oblique actions even have a bigger aspect of automation. This may lengthen even to manufacturing unit workers. Manufacturing unit administration productiveness can be increased within the US as a consequence of leaner organizations. Indian manufacturing unit managements usually are inclined to have extra supervisors and center administration. . Nevertheless even after offsetting the productiveness benefit of the US, India would have a labour benefit versus US, the full human prices being wherever between 300% increased or extra.

After this there may be the consideration of what proportion of the full price , the human price includes to reach on the influence on whole price. On this we have to membership all three categories-Direct labour, oblique labour and workers salaries. All this put collectively would usually be at a minimal of 12-15% of the full price, even in materials intensive merchandise . If the full labour price benefit is 300% , then the full price benefit would nonetheless be 45%. This may be calculated for illustration as- The Indian product can be 85+15, vs the US product’s 85+60, so Indian merchandise have some cushion towards US merchandise even after the 25% tariff. This calculation is just for illustration as there are instances the place the full human price is as a lot as 40%, making it effectively nigh inconceivable for native US corporations to compete. Nevertheless if there’s a double whammy when it comes to very low labour content material and abysmally low productiveness, then that firm may lose out because the OEM’s would count on at the least a ten% benefit for importing merchandise versus shopping for domestically. Nevertheless normally the 25% benefit, even clubbed with the ten% price differential sought by OEM’s will be overcome by Indian corporations.

.

One other issue that ought to make Indian exporters snug is that US producers can be cautious of organising capability to tackle Indian merchandise, not figuring out how far we will go in dropping costs. That is along with the truth that these low price imports characterize a comparatively smaller slice of the market. Native producers would first take a look at the low hanging fruit, ie massive volumes of excessive price imports from excessive price nations.

Nevertheless, as an alternative of taking a look at this defensively as to how we will shield our place, the administration must be taking a look at how this example can be utilized as a chance to aggressively broaden our exports to US, by placing a deal. Why this must be a troublesome train, given the above price components is baffling. Even when the duties on each single manufactured product from USA have been lowered to zero, US merchandise can not outprice Indian merchandise. US merchandise shall be purchased for worth, not value. If the obligation on a Harley Davidson as an illustration is lowered to zero, there may be unlikely to be even one purchaser of a TVS Apache or Bajaj Pulsar who would change to a Harley. Equally, even the bottom mannequin of a Tesla couldn’t compete on value towards Indian vehicles. The identical is true for each different product I do know of. The tariffs of the Authorities are to not shield Indian producers, however to generate profits off the “wealthy” consumers of those merchandise (“If somebody needs a Harley, he can pay twice the value to get it”). Soaking the wealthy on this context, is outdated considering of the Nehru period, that has no place in the present day both in economics or as right here in geopolitics.

In conclusion, whereas the 25% tariff poses little menace to Indian auto element makers, it supplies a chance the Authorities ought to seize and capitalize on. The query is whether or not they’ll rise to the event. From 1947 to 1990 India noticed the darkish ages till the P.V. Narasimha Rao-Manmohan Singh Authorities. They have been up towards the wall , however used the disaster effectively to liberalise the economic system. India then noticed an inflection level. We will hope that the current Authorities will do the identical below compulsion. It ought to , because it has taken a number of steps to advertise Indian manufacturing previously. As Winston Churchill (or Rahm Emanuel) said-“By no means let a superb disaster go to waste”. So Trump’s tariffs may effectively be excellent news and one other inflection level for the Indian economic system.

The creator has an IIT-IIM training and has over 20 years’ expertise main auto elements and manufacturing corporations in India and overseas

var _mfq = window._mfq || [];

_mfq.push([“setVariable”, “toi_titan”, window.location.href]);

!(function(f, b, e, v, n, t, s) {

function loadFBEvents(isFBCampaignActive) {

if (!isFBCampaignActive) {

return;

}

(function(f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function() {

n.callMethod ? n.callMethod(…arguments) : n.queue.push(arguments);

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://connect.facebook.net/en_US/fbevents.js’, n, t, s);

fbq(‘init’, ‘593671331875494’);

fbq(‘track’, ‘PageView’);

};

function loadGtagEvents(isGoogleCampaignActive) {

if (!isGoogleCampaignActive) {

return;

}

var id = document.getElementById(‘toi-plus-google-campaign’);

if (id) {

return;

}

(function(f, b, e, v, n, t, s) {

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

t.id = ‘toi-plus-google-campaign’;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://www.googletagmanager.com/gtag/js?id=AW-877820074’, n, t, s);

};

function loadSurvicateJs(allowedSurvicateSections = []){

const section = window.location.pathname.split(‘/’)[1]

const isHomePageAllowed = window.location.pathname === ‘/’ && allowedSurvicateSections.includes(‘homepage’)

if(allowedSurvicateSections.includes(section) || isHomePageAllowed){

(function(w) {

function setAttributes() {

var prime_user_status = window.isPrime ? ‘paid’ : ‘free’ ;

w._sva.setVisitorTraits({

toi_user_subscription_status : prime_user_status

});

}

if (w._sva && w._sva.setVisitorTraits) {

setAttributes();

} else {

w.addEventListener(“SurvicateReady”, setAttributes);

}

var s = document.createElement(‘script’);

s.src=”https://survey.survicate.com/workspaces/0be6ae9845d14a7c8ff08a7a00bd9b21/web_surveys.js”;

s.async = true;

var e = document.getElementsByTagName(‘script’)[0];

e.parentNode.insertBefore(s, e);

})(window);

}

}

window.TimesApps = window.TimesApps || {};

var TimesApps = window.TimesApps;

TimesApps.toiPlusEvents = function(config) {

var isConfigAvailable = “toiplus_site_settings” in f && “isFBCampaignActive” in f.toiplus_site_settings && “isGoogleCampaignActive” in f.toiplus_site_settings;

var isPrimeUser = window.isPrime;

var isPrimeUserLayout = window.isPrimeUserLayout;

if (isConfigAvailable && !isPrimeUser) {

loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive);

loadFBEvents(f.toiplus_site_settings.isFBCampaignActive);

loadSurvicateJs(f.toiplus_site_settings.allowedSurvicateSections);

} else {

var JarvisUrl=”https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published”;

window.getFromClient(JarvisUrl, function(config){

if (config) {

const allowedSectionSuricate = (isPrimeUserLayout) ? config?.allowedSurvicatePrimeSections : config?.allowedSurvicateSections

loadGtagEvents(config?.isGoogleCampaignActive);

loadFBEvents(config?.isFBCampaignActive);

loadSurvicateJs(allowedSectionSuricate);

}

})

}

};

})(

window,

document,

‘script’,

);