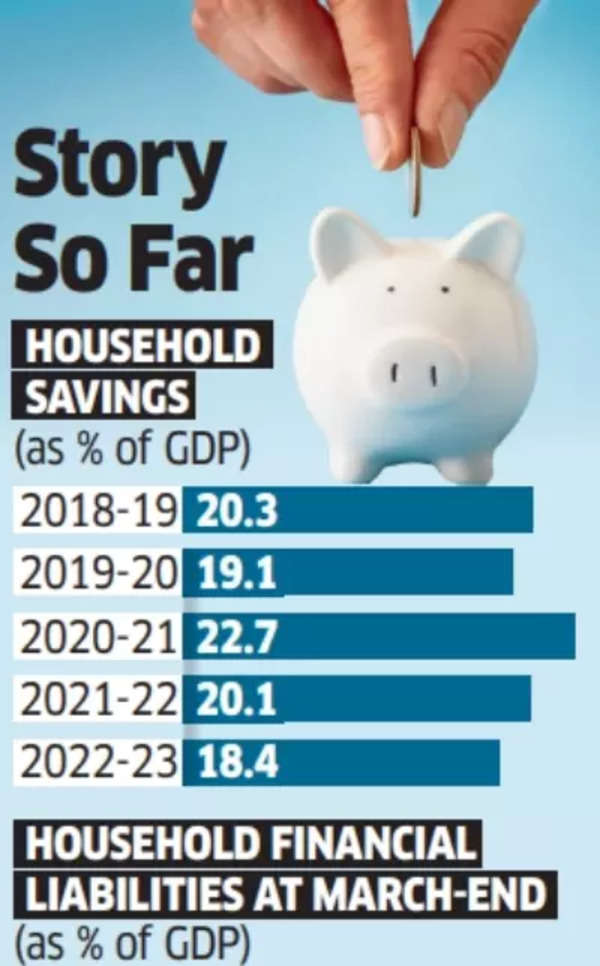

The Finance Ministry has informed the Parliament concerning the dangers related to households transferring their deposits from banks to market-linked monetary devices in search of higher returns. This shift may expose households to substantial market dangers, probably resulting in financial losses during times of market instability, significantly attributable to restricted danger evaluation capabilities and monetary consciousness, the Finance Ministry has mentioned.

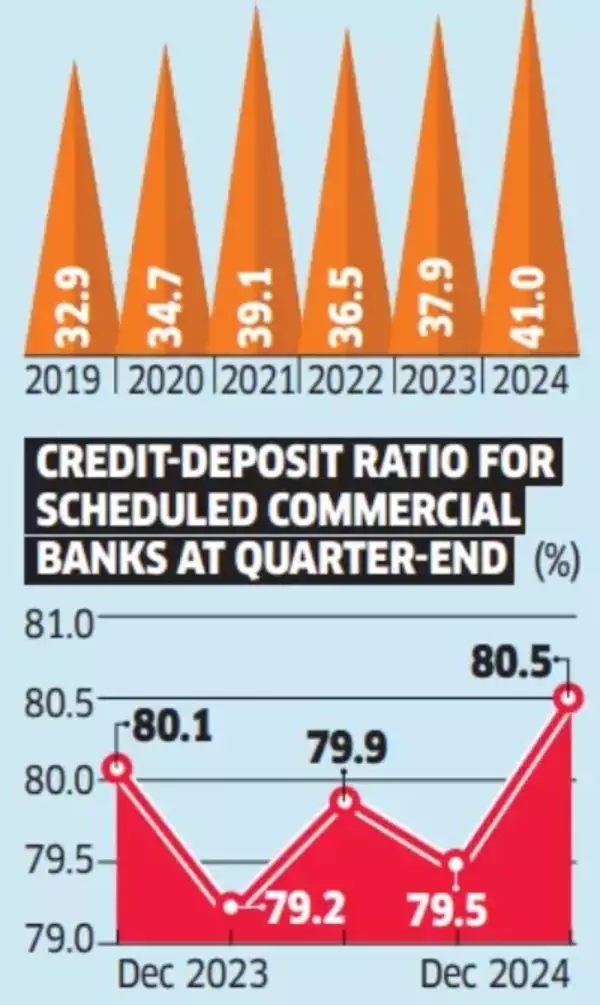

In its written response to the parliamentary standing committee relating to demand for grants, the Division of Monetary Providers famous that lowered monetary financial savings create challenges for banks’ liquidity administration. The division additional defined that when households withdraw their financial savings, banks lose entry to low-cost funding sources, consequently rising their funding bills, based on an ET report.

The committee offered its report in Parliament on Wednesday, recommending a number of measures. These included taking pre-emptive steps to deal with liquidity points, bettering buyer engagement significantly in underserved areas, and adopting technological options to reinforce operational effectivity. These measures purpose to assist banks counter the consequences of declining CASA (present account financial savings account) ratios.

Concerning the funds’s proposal for full overseas direct funding (FDI) in insurance coverage, the committee emphasised implementing protecting measures to deal with a number of issues. These embrace managing revenue repatriation to overseas nations, preserving decision-making authority of home corporations, and defending employment amidst potential automation. The committee additionally raised issues about the potential of focusing solely on worthwhile insurance policies while neglecting rural areas and economically deprived sections. They suggested that these challenges in India’s insurance coverage sector needs to be dealt with “adequately and scrupulously”.

Credit score Deposit Ratio

The committee noticed a big rise in complaints beneath the Reserve Financial institution of India’s Built-in Ombudsman Scheme, with a compound development of almost 50% over two years, reaching roughly 934,000 in 2023-24. They really useful establishing programs to resolve grievances throughout a number of sectors.

The committee burdened the significance of sustaining energetic Jan Dhan accounts and stopping dormancy or fraud. They prompt implementing thorough verification processes and common monitoring of account actions.

“Discrepancies needs to be totally investigated and accounts which can be inactive for extended intervals or discovered to be fraudulent needs to be deactivated,” it mentioned.

var _mfq = window._mfq || [];

_mfq.push([“setVariable”, “toi_titan”, window.location.href]);

!(function(f, b, e, v, n, t, s) {

function loadFBEvents(isFBCampaignActive) {

if (!isFBCampaignActive) {

return;

}

(function(f, b, e, v, n, t, s) {

if (f.fbq) return;

n = f.fbq = function() {

n.callMethod ? n.callMethod(…arguments) : n.queue.push(arguments);

};

if (!f._fbq) f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://connect.facebook.net/en_US/fbevents.js’, n, t, s);

fbq(‘init’, ‘593671331875494’);

fbq(‘track’, ‘PageView’);

};

function loadGtagEvents(isGoogleCampaignActive) {

if (!isGoogleCampaignActive) {

return;

}

var id = document.getElementById(‘toi-plus-google-campaign’);

if (id) {

return;

}

(function(f, b, e, v, n, t, s) {

t = b.createElement(e);

t.async = !0;

t.defer = !0;

t.src = v;

t.id = ‘toi-plus-google-campaign’;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

})(f, b, e, ‘https://www.googletagmanager.com/gtag/js?id=AW-877820074’, n, t, s);

};

function loadSurvicateJs(allowedSurvicateSections = []){

const section = window.location.pathname.split(‘/’)[1]

const isHomePageAllowed = window.location.pathname === ‘/’ && allowedSurvicateSections.includes(‘homepage’)

if(allowedSurvicateSections.includes(section) || isHomePageAllowed){

(function(w) {

function setAttributes() {

var prime_user_status = window.isPrime ? ‘paid’ : ‘free’ ;

w._sva.setVisitorTraits({

toi_user_subscription_status : prime_user_status

});

}

if (w._sva && w._sva.setVisitorTraits) {

setAttributes();

} else {

w.addEventListener(“SurvicateReady”, setAttributes);

}

var s = document.createElement(‘script’);

s.src=”https://survey.survicate.com/workspaces/0be6ae9845d14a7c8ff08a7a00bd9b21/web_surveys.js”;

s.async = true;

var e = document.getElementsByTagName(‘script’)[0];

e.parentNode.insertBefore(s, e);

})(window);

}

}

window.TimesApps = window.TimesApps || {};

var TimesApps = window.TimesApps;

TimesApps.toiPlusEvents = function(config) {

var isConfigAvailable = “toiplus_site_settings” in f && “isFBCampaignActive” in f.toiplus_site_settings && “isGoogleCampaignActive” in f.toiplus_site_settings;

var isPrimeUser = window.isPrime;

var isPrimeUserLayout = window.isPrimeUserLayout;

if (isConfigAvailable && !isPrimeUser) {

loadGtagEvents(f.toiplus_site_settings.isGoogleCampaignActive);

loadFBEvents(f.toiplus_site_settings.isFBCampaignActive);

loadSurvicateJs(f.toiplus_site_settings.allowedSurvicateSections);

} else {

var JarvisUrl=”https://jarvis.indiatimes.com/v1/feeds/toi_plus/site_settings/643526e21443833f0c454615?db_env=published”;

window.getFromClient(JarvisUrl, function(config){

if (config) {

const allowedSectionSuricate = (isPrimeUserLayout) ? config?.allowedSurvicatePrimeSections : config?.allowedSurvicateSections

loadGtagEvents(config?.isGoogleCampaignActive);

loadFBEvents(config?.isFBCampaignActive);

loadSurvicateJs(allowedSectionSuricate);

}

})

}

};

})(

window,

document,

‘script’,

);