US President Donald Trump’s reciprocal tariffs are reshaping the worldwide commerce panorama. Beginning April 2, 2025, the US will impose reciprocal tariffs on nations that levy greater duties on American items, together with India. This announcement has created uncertainty amongst key buying and selling companions of the US and sparked discussions about its potential financial influence.

However what does this imply for Indian companies, commerce relations, and the financial system? Let’s perceive.

Present standing of India and US commerce relations

India-US financial relations year-on-year (worth in US$ million)

| Commerce actions | FY 2019-20 | FY 2020-21 | FY 2021-22 | FY 2022-23 | FY 2023-24 |

|---|---|---|---|---|---|

| India’s exports to the US | 53,088.77 | 51,623.14 | 76,167.01 | 78,542.60 | 77,515.03 |

| Progress (%) | -2.76 | 47.54 | 3.12 | -1.31 | |

| India’s imports from the US | 35,819.87 | 28,888.10 | 43,314.07 | 50,863.87 | 42,195.49 |

| Progress (%) | -19.35 | 49.94 | 17.43 | -17.04 | |

| Complete commerce | 88,908.65 | 80,511.24 | 119,481.08 | 129,406.47 | 119,710.52 |

| Progress (%) | -9.44 | 48.40 | 8.31 | -7.49 |

Supply: Division of Commerce, Ministry of Commerce and Trade, GoI

Supply: Division of Commerce

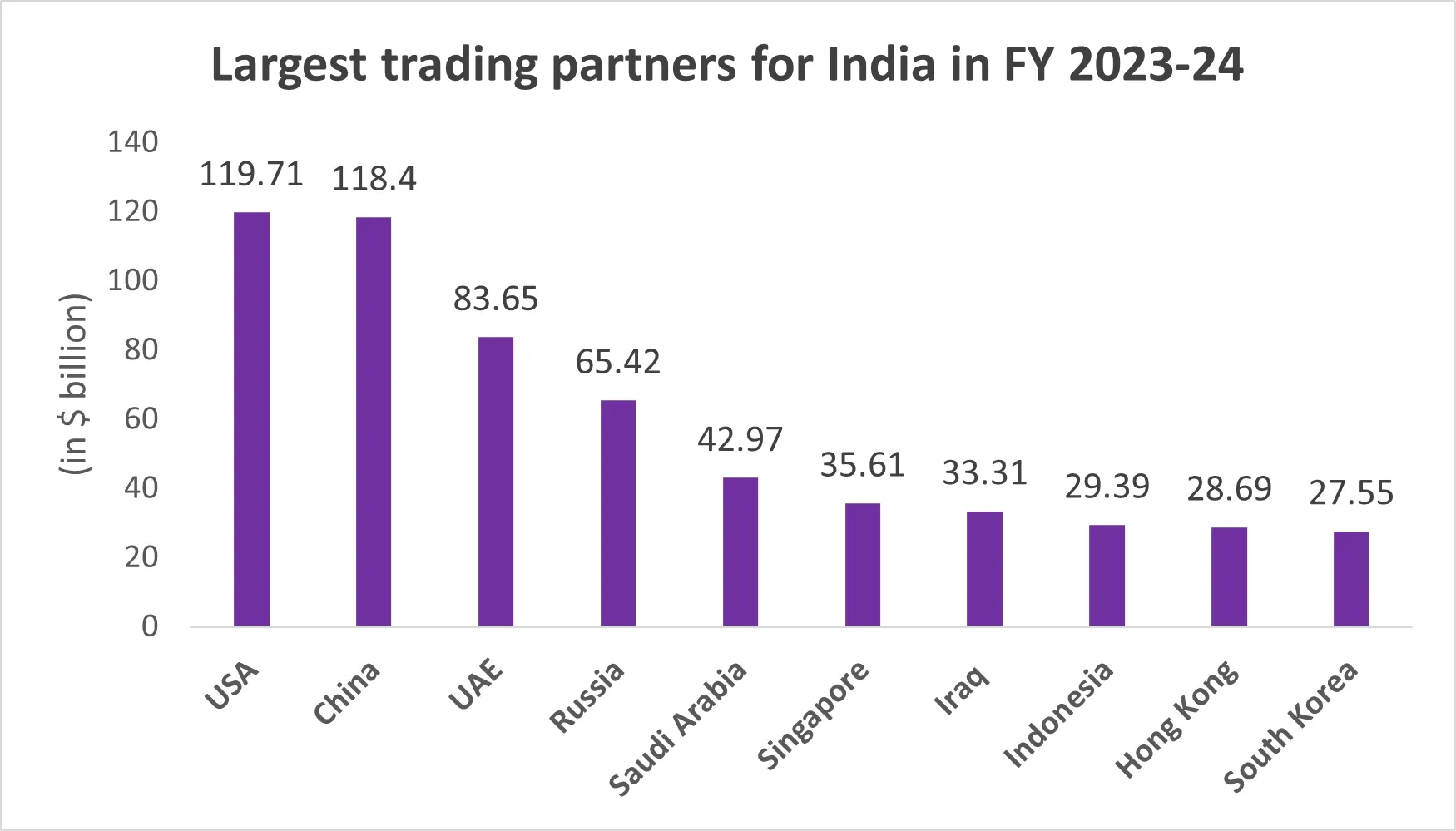

Therefore, it’s clear that India is extra reliant on the US for commerce.

Supply: India’s Ministry of Commerce and Trade

Supply: US Census Bureau

However now, issues have taken a U-turn.

Trump’s criticism of India’s excessive tariffs on US items, calling them “unfair” to the US and imposing reciprocal tariffs has raised some issues for India.

For context, India’s tariff charges, whereas aligned with its protecting financial technique, are considerably greater than these of the US, particularly in key sectors comparable to agriculture, textiles, cars and prescribed drugs. India imposes a weighted common tariff of 8.5% (adjusted for the discount within the latest funds) on US imports, whereas the US maintains a a lot decrease common of three%.

Though this abrupt realisation of excessive tariffs could possibly be one issue, the principle motive behind Trump’s reciprocal tariffs determination is to slender the rising US commerce deficit hole with India and to spice up tariff revenues to make up for decreased company tax revenue.

FYI: During the last decade, India’s items commerce surplus with the US has doubled to $35 billion, which represents practically 1% of India’s GDP in FY 2023-24. A lot of this surplus has been pushed by India’s sturdy exports in sectors like electronics, prescribed drugs, IT companies and textiles.

What would be the influence of Trump’s reciprocal tariff on India?

This can be a debatable topic in the intervening time.

- A analysis report by Morgan Stanley states the direct influence of reciprocal tariff hikes will probably be manageable for India; nonetheless, the oblique influence by commerce uncertainty weighing on enterprise confidence is extra worrisome.

- Based on Citi Analysis, the reciprocal tariffs imposed by the US may result in annual losses of $7 billion for India.

- A report by Nomura states India is among the many least susceptible Asian nations on this commerce warfare.

- Based on SBI Analysis, the influence of US tariffs on Indian exports to the US would probably be restricted to simply 3% to three.5%.

Whereas specialists have totally different views on the potential influence of reciprocal tariffs on India, one factor is definite.

India will face a comparatively smaller influence on account of its diversified export portfolio and rising commerce relationships with different areas comparable to Europe and the Center East. India has strategic partnerships and free commerce agreements with nations just like the UAE, Australia, and the European Union. Furthermore, India can be a member of boards just like the Regional Complete Financial Partnership (RCEP) and BRICS. These sturdy international partnerships are anticipated to cushion the influence of US tariffs on India.

There’s one other fascinating level right here.

With Trump imposing 25% tariffs on Mexico and Canada (its high two commerce companions) and 20% on China, India may gain advantage from these strained commerce relationships by exporting extra expertise, electronics and jewelry to the US. However this might be doable provided that India expands its provide functionality to export to the world and turns into globally aggressive within the merchandise that the US presently depends on its key buying and selling companions.

Whereas specialists imagine that Trump’s reciprocal tariff plan could become extra of “white noise” for India’s exports, few sectors may bear the warmth of the tariff warfare.

Sectors that could be impacted

– Pharma

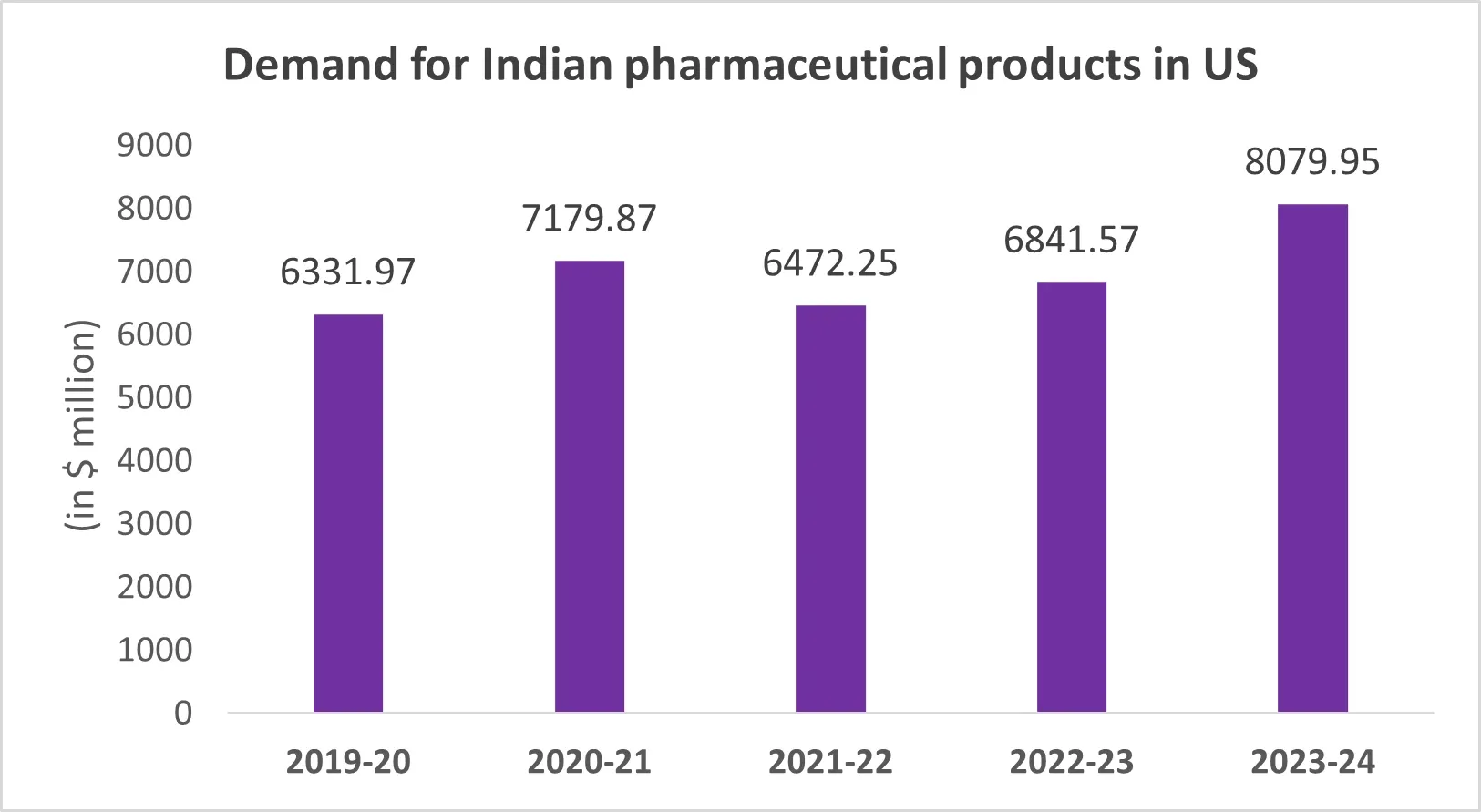

There’s a huge demand for Indian medicine within the US market. As many as 4 out of 10 prescriptions stuffed within the US in 2022 are equipped by Indian corporations.

Supply: Ministry of Commerce and Trade

At present, there isn’t any import responsibility on Indian prescribed drugs within the US. Nevertheless, India levies round 10% import responsibility on American medicine.

If the US imposes tariffs on pharma merchandise, it would improve the export price for a lot of pharma corporations. A sudden worth surge may scale back the demand of Indian medicines within the US, resulting in losses for Indian pharmaceutical corporations.

– Agriculture

Given the extensive tariff hole of practically 40% between India and US within the agriculture sector, if the US decides to impose reciprocal tariffs on a wider array of agricultural items, India’s meals and farm exports, together with shrimp, dairy, and processed meals, may see substantial disruptions.

Whereas the commerce volumes on this sector are comparatively low, the tariff variations may result in the sector going through import duties of as much as 38.2%.

– Specialty chemical substances

India is without doubt one of the largest suppliers of agrochemicals, dyes, and fluorochemicals to US producers. At present, natural and miscellaneous chemical substances face a ten% tariff in India, whereas the US common tariff for comparable merchandise is round 3%.

If a 7% tariff is imposed on Indian specialty chemical substances exported to the US, it could considerably dent exporters’ earnings and so they may see a drop of as much as 12% in EBITDA as per Citi Analysis estimates.

– Gems and jewelry

India is a serious exporter of gems and jewelry, with the US importing $8.5 billion price in 2024. Nevertheless, a big tariff hole stays a priority. Whereas the US imposes a 2.1% responsibility, India levies round 15.4% on imports on this sector. With reciprocal tariffs coming into impact, the gems and jewelry business is more likely to face main setbacks.

Different key sectors that would come below stress on account of reciprocal tariff hikes are electrical, industrial equipment, fuels, textiles, iron & metal, and cars.

However as they are saying, each coin has two sides, can this cloud even have a silver lining? Let’s discover out.

The optimistic influence of Trump’s tariffs on the Indian financial system

Based on former RBI Deputy Governor Viral Acharya, Trump’s tariff coverage is anticipated to spice up India’s financial system, as the federal government goals to scale back commerce obstacles to counter the tariff menace.

It can additionally encourage Indian companies to place themselves as international leaders. Small, medium and huge enterprises can decrease their manufacturing prices with the help of the Indian authorities, making tariffs much less impactful.

Moreover, the potential migration of corporations from China to India, pushed by decrease tariffs, may considerably profit India. It may increase manufacturing and create alternatives for Indian producers and exporters.

However right here’s the factor. Quite a lot of these optimistic impacts rely on the Indian authorities’s response to the tariff warfare.

India’s efforts to ease commerce tensions

To mitigate commerce tensions, India and the US are collaborating in direction of a mutually helpful commerce settlement. Each nations have set an formidable objective below “Mission 500” to double bilateral commerce to $500 billion by 2030. A key element of this effort might be negotiations for a multi-sector bilateral commerce settlement by 2025, specializing in decreasing tariff and non-tariff obstacles, bettering market entry, and strengthening provide chain integration.

India is making efforts to strengthen commerce ties. We noticed the measures launched within the 2025 Union Funds to ease commerce tensions. Moreover, India has already slashed tariffs on a number of gadgets. For example, tariffs on high-end bikes have been lowered from 50% to 30%, whereas these on bourbon whiskey have been minimize from 150% to 100%. As well as, India has pledged to reassess different tariffs, increase vitality imports, and improve defence tools purchases from the US.

Wanting forward, all eyes at the moment are on the Indian authorities’s response to the “Trump Card” as it would resolve the nation’s financial progress and sustainability.